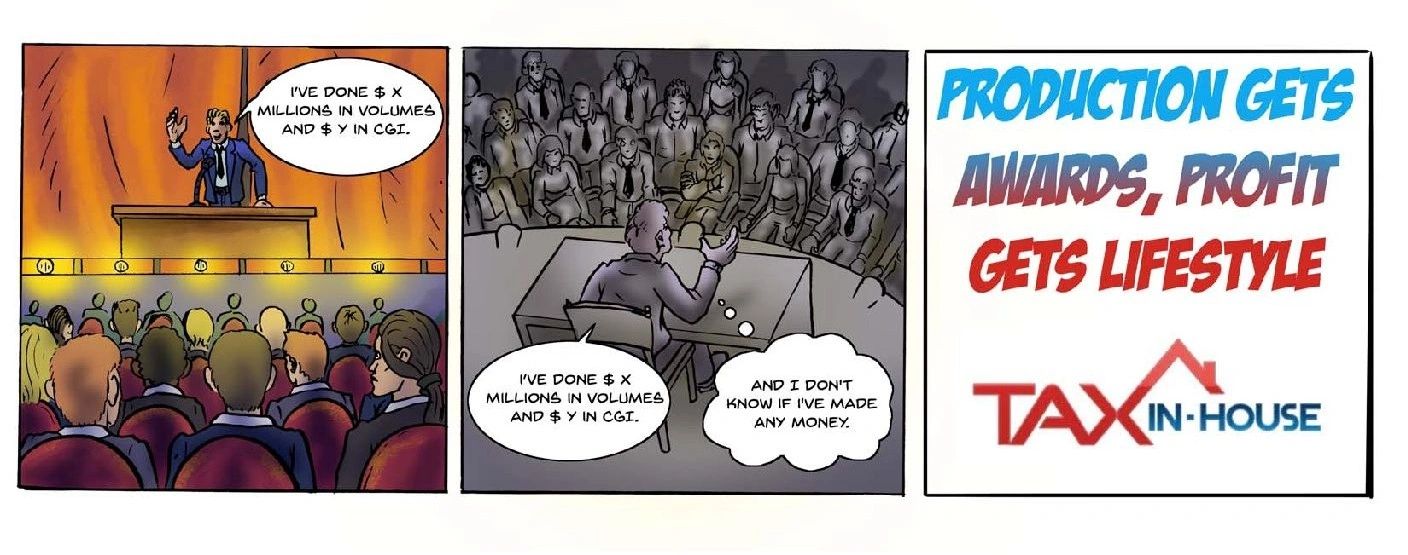

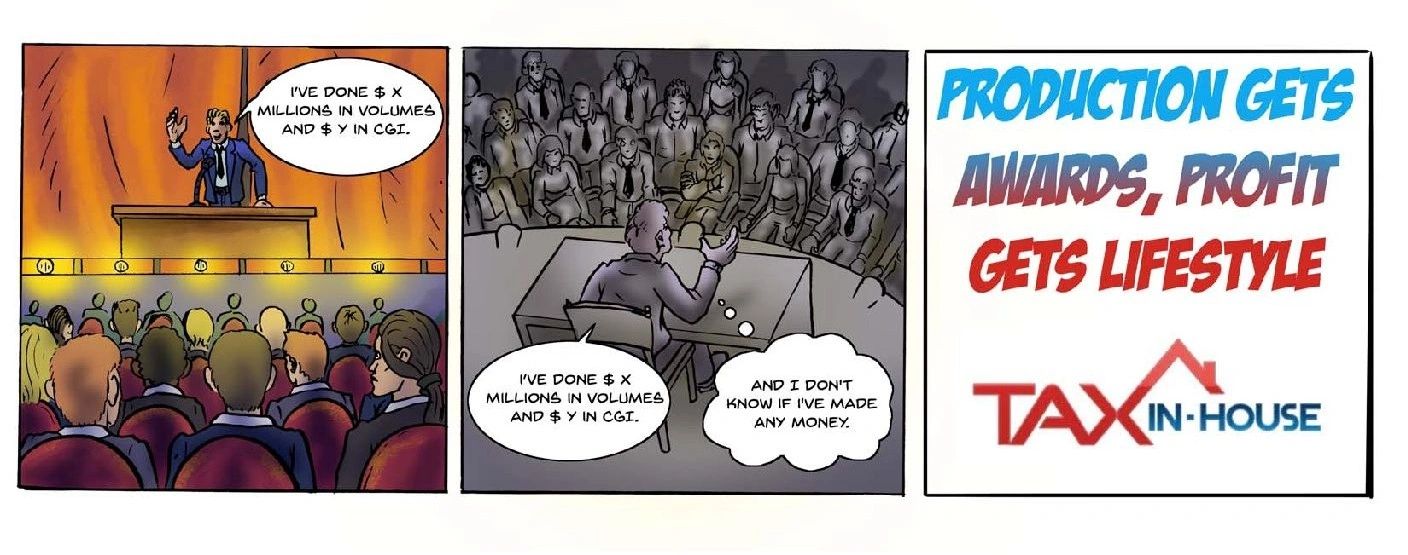

America's #1 MREA Based Tax and Accounting Firm. For Real Estate Agents.

Tax In House is the preeminent MREA based bookkeeping firm in America. With a collaborative and education-based focus, and well over a decade of highly specific experience, we help real estate agents master "the language of business' that is accounting. Our classes have helped educate many thousands of real estate agents gain understanding into their business financials. Our flat-rate monthly service helps 100s of real estate sales businesses gain clarity into their businesses while also offloading all things S-Corp related: taxes, bookkeeping, a payroll file & guidance, tax guidance, general business consulting. Call our team of experts today!

Tax law is the area of law that deals with the rules, regulations, and laws that govern taxation. This includes federal, state, and local taxes, as well as tax-related issues such as audits, appeals, and litigation.

Tax planning is the process of analyzing a financial situation or plan from a tax perspective. The goal of tax planning is to ensure tax efficiency, which means paying the lowest amount of tax possible. Tax planning can involve a variety of strategies, such as shifting income, maximizing deductions, and deferring taxes.

A tax audit is an examination of a taxpayer's financial records and accounts by tax authorities such as the IRS. The purpose of a tax audit is to ensure that the taxpayer is in compliance with tax laws and regulations. Tax audits can be conducted in person, by mail, or by telephone.

Tax litigation is the process of resolving legal disputes related to taxes. This can include disputes with tax authorities such as the IRS, as well as disputes between taxpayers and other parties. Tax litigation can involve a variety of legal issues, including tax fraud, tax evasion, and tax appeals.

Estate planning is the process of preparing for the transfer of a person's assets and property after their death. This can include creating a will, establishing trusts, and ensuring that tax obligations are met. Estate planning can be complex, and it is important to work with an experienced tax attorney to ensure that your wishes are carried out.

Business tax planning is the process of analyzing a business's financial situation or plan from a tax perspective. The goal of business tax planning is to ensure tax efficiency, which means paying the lowest amount of tax possible while remaining in compliance with tax laws and regulations.

Occasional emails musings about tax, accounting, and business matters that affect real estate agents

Copyright © 2025 Tax In-House - All Rights Reserved.

Knowledge is power, control your future

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.